Don’t Panic: Stock Market Fluctuations are Normal

Nothing is more unsettling than a roller coaster stock market, which can send participants into panic mode as they nervously watch wild dips in their 401k plans.

Always remember the time-honored saying: it’s a marathon not a sprint. Simply put, long-term investing is meant to weather the storm of a volatile stock market and reacting irrationally is the last thing investors should do.

How do you keep calm amidst blaring headlines of financial fear and collapse? Here are a few simple tips that can keep nerves at bay.

This is Normal

We’ll say it again: market fluctuation is absolutely normal. According to Fidelity, “history shows that the US stock market has been able to recover from declines and can still provide investors with positive long-term returns.” They add that in the past 35 years, the market experienced an average drop of 14% from high to low during each calendar year, yet still produced positive annual returns in more than 80% of the calendar years in this period.[1]

Stay the Course

Having a plan —and sticking to it— is vital. Most 401k participants don’t need their investments right away so as long as they have a diversified asset mix that reflects “time horizon, financial situation, and risk tolerance,” they should ride it out. [2]

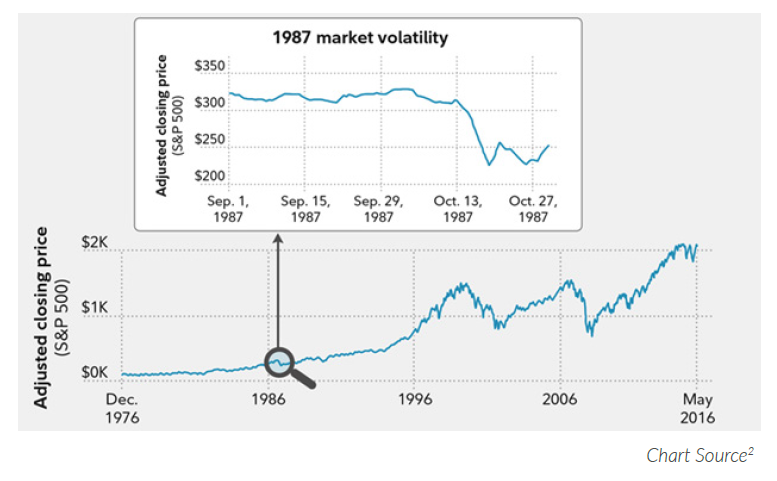

Also, what seems like a wild ride in the moment, is barely a blip in the long-run of investing.

When the 1987 market crash had “the S&P 500® Index careening down about 20% in 4½ days, sending shivers through investors’ veins,” a chart showing that exact time period makes the drop look intense.[3] However, when taken in a 40-year perspective, the same dip is barely noticeable.[4]

Markets Recover

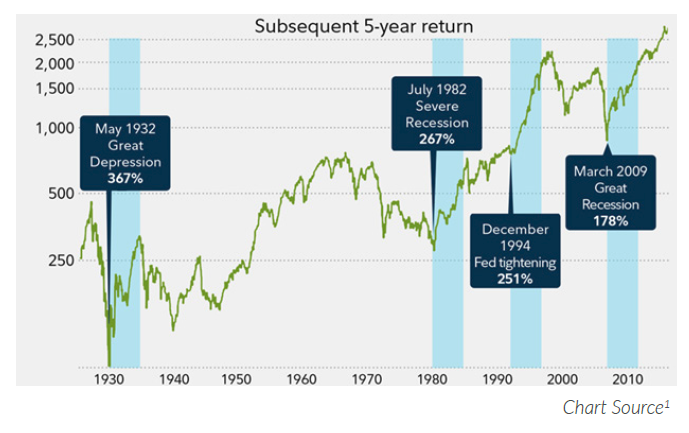

The good news is that even with down months, or years, in the stock market, its rebound is just a matter of time.

Historically, the major crashes of the last century saw predictable periods of recovery. Even the most recent 2008 market crash that lead to a 178% drop in 5-year returns began its recovery almost immediately.

By 2013, the stock market was seen as fully recovered and by February 2018, the Dow Jones Industrial Average had set more than 250 closing records.[5]

Keep Calm and Invest On

Besides staying calm, what else should investors do during a bear market? Here are three options that experts recommend investors consider:[6]

Buy when prices are low during a downturn. Invest a fixed amount on a regular schedule, which generally results in buying more shares when prices are low and less when they are high.

Review and rebalance your portfolio. Add some of the “beaten-down” investments, which can help manage risk level and position a portfolio for a potential recovery.

Assess your allocation. Based on your retirement date, you should be invested appropriately. If you have a longer time horizon you can stand to have more aggressive investments, but if you are nearing retirement, your investments should be a bit more secure. Think about it: if you’re driving down the highway and your exit is coming up in 100 ft, would you rather be going 85 in the left lane or preparing to merge into the exit lane with your blinker on?

We’ve Seen it Before

As investment advisors and retirement specialists, we’ve helped hundreds of clients weather market volatility. We’re happy to discuss any of these tips or help develop a strategy for individual or institutional retirement plan solutions.

Remember, the most important advice is to remember to breathe, don’t panic, and focus on the light at the end of the investment tunnel.

CURTIS S. FARRELL, CFP® AIF®

949.455.0300 x222 | cfarrell@fmncc.com | fmncc.com

***

Investment advisory services are offered by Financial Management Network, Inc. (“FMN”) and securities offered through FMN Capital Corporation, (“FMNCC”), member FINRA & SIPC.

[1] Fidelity Viewpoints. “6 tips to manage volatile markets.” 20, Dec. 2018.

[2] Fidelity Viewpoints. “Beat market volatility fears.” 3, Dec. 2018.

[3] Carlson, Mark, Board of Governors of the Federal Reserve, “A brief history of the 1987 stock market crash with a discussion of the Federal Reserve response.” 25, Nov. 2006.

[4] Fidelity Viewpoints. “Beat market volatility fears.” 3, Dec. 2018.

[5] Amadeo, Kimberly. “Stock Market Crash of 2008.” The Balance. 6, Nov. 2018.

[6] Fidelity Viewpoints.” The upside of a down market.” 29, Jan, 2019.