PLAN ADMINISTRATION IS A HASSLE

…but does it have to be?

3 Tips for Managing 401(k) Plan Administration Headaches

As an HR professional, you have mastered the art of juggling and hopefully you look good in hats, because you’re likely to find yourself wearing a number of them in varying situations. Being the administrator of your 401(k) plan adds a few extra hats to the rack. Your role changes from accountant for payroll, to attorney when reviewing plan documents or a teacher for the plan participants.

In this article we hope to lend some helpful information, tools and ideas that may help you manage your responsibilities as a plan sponsor and hopefully make your life a bit easier.

Payroll

Every payroll period, administrators are required to submit payroll and 401(k) contributions in a timely manner. If you are still taking a manual entry approach, you understand how arduous that process can be. Many administrators may feel like the middleman stuck between your payroll provider and recordkeeper, or a rock and a hard place. Fortunately, payroll is a process that can be automated and integrated to reduce potential data input errors and give you back valuable time.

Partnership with a quality provider that can bear this burden or a seamless payroll integration may ease the pain of this ongoing task. The solution that’s best for you will depend on a few different factors, however, here are the three most common approaches:

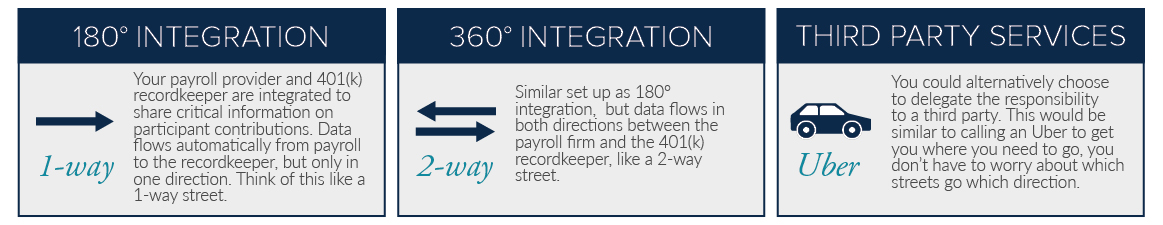

180° integration — Your payroll provider and 401(k) recordkeeper are integrated to share critical information on participant contributions. Data flows automatically from payroll to the recordkeeper, but only in one direction. Think of this like a 1-way street.

360° integration — Similar set up as 180° integration, but data flows in both directions between the payroll firm and the 401(k) recordkeeper, like a 2-way street.

Third Party Services — You could alternatively choose to delegate the responsibility to a Third Party. This would be similar to calling an Uber to get you where you need to go, you don’t have to worry about which streets go which direction.

Following Plan Documents

Failure to follow plan documents has been cited as one of the top 3 ERISA violations.[i] In the landmark case of Tussey v. ABB, Inc., some pretty steep penalties were paid: $36.9 million in damages was awarded to plan participants. Among the fiduciary violations was failure to follow the terms of plan documents.[ii]

Fortunately, you can learn from this case and with a bit of guidance, you may be able to avoid that same fate. If it has been a while, consider dusting off and reviewing theses governing documents:

- plan document

- trust agreement

- service provider agreements

- committee by laws or charter

- investment policy statement (IPS)

- summary plan description (SPD)

If this important fiduciary step seems daunting, you are not alone. Documents can be difficult to decipher as they are often written in tedious legal language and can be hundreds of pages long. (Your advisor can help with this process.)

One of the most heavily utilized and referenced items on that list is a condensed version of your plan document, a “Summary Plan Description”. An SPD is a summary of the key features of your 401(k) plan and eases understanding, allowing its use for participant education and administrative reminders as needed.

We have developed an abridged version that outlines some of the most referenced items such as eligibility timeline, enrollment periods, and distributions. Download our free template by clicking the button below.

Employee Education

How often are you approached with technical questions about your company’s retirement plan? Did you know that the simple act of discussing certain aspects of the company retirement plan with your employees could open you up to fiduciary risk? This a job for your advisor, not a burden you should have to bear. We understand that vesting schedules, risk tolerance, retirement income replacement ratios, social security integration, and non-qualified deferred compensation contributions are not your full-time job. As Retirement Specialists, this is what we do! We are licensed and available to answer the complex questions your employees may have.

Many of the tasks involved in plan administration can seem time consuming, tedious or just an outright pain in the neck at times. However, we like to look at these responsibilities as a safeguard and believe that, if done right, they may help you dodge fiduciary nightmares. For more information on how Financial Management Network can help relieve some of your administrative stress, contact us today!

[i] Donaldson, David. “Plan Management: Through the Eyes of a Former DOL Senior Investigator.” ERISA Smart. 2015.

[ii] Wagner, Marcia. “Legal Update: Tussey vs. ABB, Inc.” Jan. 2015.

Investment advisory services are offered by Financial Management Network, Inc. (“FMN”) and securities offered through FMN Capital Corporation, (“FMNCC”), member FINRA & SIPC.

The Top DC Advisor Firms is an independent listing produced annually (September 2017) by The National Association of Plan Advisors(NAPA). The NAPA Top DC Advisor Firms is a compilation of leading individual advisor Firms, or teams, ranked by DC assets under advisement. This award does not evaluate the quality of services provided to clients and is not indicative of this advisor’s future performance. Neither the advisors nor their parent firms pay a fee to NAPA in exchange for inclusion on this list.

The “Top 100 Retirement Plan Advisers 2016” list by PLANADVISER Magazine recognizes individuals, teams, and multi-office teams according to quantitative measures, including the dollar value of qualified plan assets under advisement as well as the number of plans under advisement. Nominations were solicited online from retirement plan advisers, their employers and/or broker/dealers, and plan sponsors, as well as from working partners of these advisers, including investment vendors, accountants and attorneys, and pension administrators.

The Financial Times 401 Top Retirement Plan Advisors is an independent listing produced by the Financial Times (September 2016). The FT 401 is based on data gathered from financial advisors, regulatory disclosures, and the FT’s research. The listing reflects each advisor’s status in seven primary areas, including DC plan assets under management, growth in DC plan business, specialization in DC plan business, and other factors. This award does not evaluate the quality of services provided to clients and is not indicative of this advisor’s future performance. Neither the advisors nor their parent firms pay a fee to Financial Times in exchange for inclusion in the FT 401.